The major U.S. indexes moved modestly higher last week, with tech stocks outperforming other sectors. During the minutes released last Wednesday, the FOMC predicted that economic activity would continue to expand at a moderate pace and stated that labor market conditions remain strong. The central bankers were also optimistic about achieving their 2% inflation target and that gradual increases in the federal funds rate would be necessary – although these sentiments have sparked concerns among investors.

International markets were mixed over the past week. Japan's Nikkei 225 fell 0.74%; Germany's DAX 30 rose 0.26%; and Britain's FTSE 100 fell 0.71%. In Europe, the IHS Markit Eurozone PMI fell from 58.8 in January to 57.5 in February, but growth remains solid in the region. In Asia, China proposed scrapping the presidential term limit, which would clear the way for Xi Jinping to stay in power at a time when the country's growth is slowing.

The SPDR S&P 500 ETF (ARCA: SPY

) rose 0.59% over the past week. After briefly touching the 200-day moving average at around $253.00, the index rebounded to the 50-day moving average at $272.47. Traders should watch for a breakout to the pivot point at $278.64 or a breakdown to retest S2 support at $259.41. Looking at technical indicators, the relative strength index (RSI) rose to neutral levels of 54.22, while the moving average convergence divergence (MACD) could see a near-term bullish crossover following its bearish crossover in late January in a sign that things could be turning around. (See also: Selling Stocks on Rally Is New Mantra Amid Market's Swings.)

The SPDR Dow Jones Industrial Average ETF (ARCA: DIA

) rose 0.38% over the past week, making it the worst performing major index. After the index briefly broke below S2 support at $238.70, it rebounded to the 50-day moving average at $251.54. Traders should watch for a breakout to the pivot point at $257.49 or a breakdown to retest S2 support levels. Looking at technical indicators, the RSI appears neutral at 53.07, but the MACD experienced the start of a bullish crossover that could signal further upside ahead.

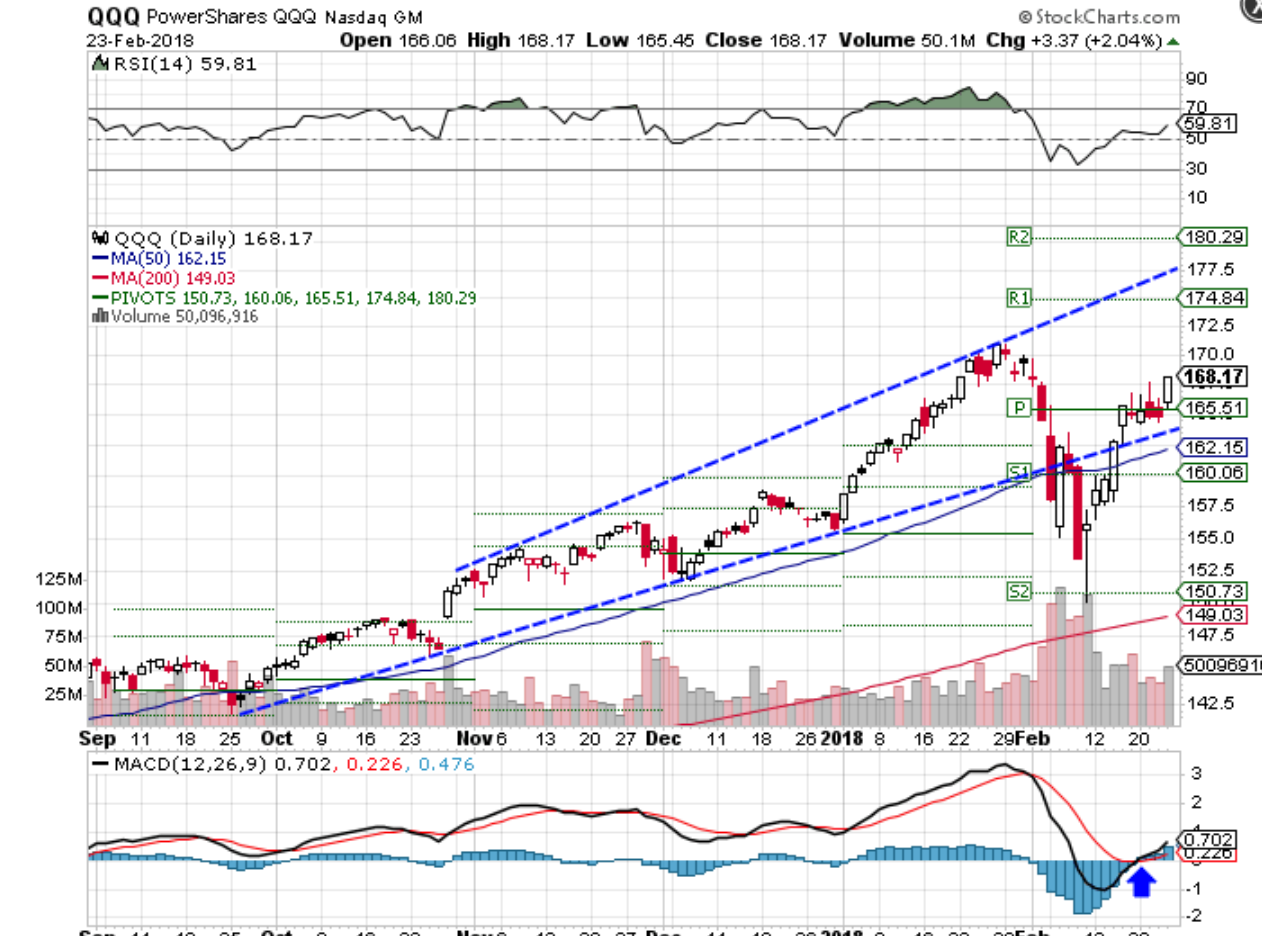

The PowerShares QQQ Trust (NASDAQ: QQQ

) rose 1.95% over the past week, making it the best performing major index. After briefly touching S2 support levels at $150.73, the index rebounded above its pivot point at $165.51. Traders should watch for a breakout to retest highs at around $171.00 or a breakdown to retest lower trendline support at around $163.00 or the 50-day moving average at $162.15. Looking at technical indicators, the RSI appears neutral at 59.81, while the MACD experienced a bullish crossover. (For more, see: Why Amazon, Microsoft, Netflix Pose a Risk to Stock Market.)

The iShares Russell 2000 Index ETF (ARCA: IWM

) rose 0.42% over the past week. After briefly breaking below the 200-day moving average, the index rebounded to S2 support levels at around $152.34. Traders should watch for a breakout to the pivot point at $156.48 or a breakdown to test S2 support levels at $148.32. Looking at technical indicators, the RSI appears neutral at 53.65, while the MACD could see a near-term bullish crossover.

The Bottom Line

The major indexes moved modestly higher last week, with many indexes nearing a bullish MACD crossover that could signal further upside ahead. Next week, traders will be closely watching new home sales on Feb. 26, GDP data on Feb. 28 and consumer sentiment data on March 2. The market will also be keeping a close eye on evolving geopolitical risks. (For additional reading, check out: 6 Stocks That Will Rise With the Global Economy.)

Read more: Inflation Remains a Worry as Stocks Post Modest Gains | Investopedia https://www.investopedia.com/news/inflation-remains-worry-stocks-post-modest-gains/#ixzz58JOQzXFo

Follow us: Investopedia on Facebook

SHARE

SHARE