【往事百語53】拒絕要有代替

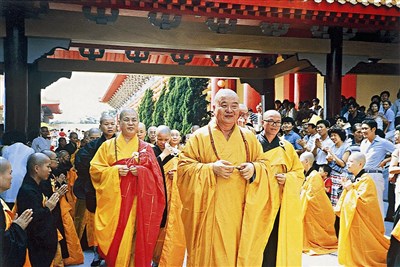

【作者:佛光山開山星雲大師】

Date: 2015-08-27

我的弟子除求學的以外,大部分都分布在佛光山海內外各個別分院及事業單位,從事弘法利生的工作。他們克盡厥責,熱忱有餘,但由於方便不夠,有時讓信徒難過而不自知。有鑑於此,我在佛光山的一次徒眾講習會中,語重心長地告訴大家:「什麼人能幹,什麼人不能幹,從一個小地方就可以看出來。凡是能幹的人,叫他做什麼事,他大部分都是承諾:『OK!OK!』『沒問題!沒問題!』不能幹的人則推三阻四,事事拒絕:『這個不對,那個不可行。』當然有很多事情實在不容易做到,但是我們在拒絕的時候要有代替,不要讓對方難堪,而且要時時想到給別人一個助緣。」一年之後的徒眾講習會,許多回山的弟子們告訴我:他們秉持「拒絕要有代替」的方針來待人處事,不但得到許多讚美,而且使道場的法務蒸蒸日上。在欣慰之餘,回想自己數十年來,因為秉持「拒絕要有代替」的處事方針,不知結下多少善緣。

二、三十年前,經常有信徒的子弟來找我,希望我能為他們介紹一份工作,或者推薦他到某機關任職。那個時候人浮於事,要找一份差事很不容易,更何況自己也不知道幫他介紹的工作適不適合,更不知道他的耐心、恆心、毅力究竟如何,但是基於和信徒之間的香火因緣,總想要助他一臂之力。於是千辛萬苦,打聽聯絡,穿針引線,好不容易幫他找到職業,趕忙去通知他,不料對方卻說:「不要了,我已經在別處上班了。」我當時心想:自己白費一場心也就算了,但是對機關主管失去信用,要我如何交代呢?他們也是賣一個面子啊!這種情況幾次以後,再有人找我介紹工作,我心裡雖也起了警覺,但輕言「拒絕」,斷了別人的信心,總是於心不忍,所以我想出了一個「代替」的辦法告訴他:「你先看報紙的尋職欄,或者我提供一些資料給你,你認為這個職業和你的能力、興趣吻合,就自己打電話過去。」對方往往說:「不行啊!他們不認識我,又沒有人介紹,不會採用我的。」我告訴他:「你可以向機關行號的主管介紹自己的專長,並且說:『我讓你試用兩個月,兩個月以後,如果你覺得我可以用,再續用;如果你覺得我不適合,我就走。我是來讓你試用的。』老闆聽說你是來讓他試用的,他不需要負什麼責任,也沒有人情負擔,就會試用你。如果你能經得起試用,可能就會一帆風順,前途光明;如果你經不起試用,那就得重新調整自己,重新學習。」經過我這一番分析說明,年輕人求職大都能無往不利。

創建佛光山以來,最常見的是一些夫妻吵架,其中一方負氣離家出走,或者一些小孩被師長責罵,在羞愧懊惱下不告而別。他們常常一來山上,就請求出家,這種情況當然不能收留,但如果一口「拒絕」,不但無法幫助對方解決苦惱,而且如果這個人再一走了之,可能一家人都會因此而陷入悲傷的情境,所以我採取「代替」的方式,在談話中得知他的住址、電話,悄悄地和他的家庭聯絡。結果家人聞訊趕來,一番懇談之後,夫婦和好如初,父母子女重逢相聚,每次看著他們歡歡喜喜地攜手下山,心中的欣悅真是不可言喻。

也有一些人來山找工作,要求長期掛單,但他本身沒有一技之長,而山上又不缺員工,我總是以關懷「代替拒絕」,先請他喝茶、用飯,等他吃飽了,再和他詳談,以鼓勵的言語勸他奮發向上,並且建議他可以先到某某地方做一個短期的幫工。雖然一時無法達到他的願望,但是因為我們的誠意讓他心裡感到很溫馨,所以往往讓對方言謝而歸,同時也結下一個美好的法緣。

常有一些慈善團體向我化緣,如果當時身上有錢,我十分樂於隨喜,偏偏我生性沒有儲蓄的習慣,經常這手收到的供養金,那手又拿去布施結緣,因此經常有出手不便的時候,但又不忍心讓他們空手而歸,這時我趕快搬出自己的著作,請對方拿去義賣,這樣一來既可以滿足來者的需要,又能流通佛法,豈不比斷然「拒絕」更為美好?

一生之中最困窘的是別人向我告貸,因為實際上佛光山開山三十年來,都是在「以無為有」中度日。龐大的弘法事業所費不貲,我們的每一分錢都是用在刀口上,但有多少人能真正瞭解呢?許多人只看到外表的富麗堂皇,卻沒有想到背後有多少不為人知的辛酸血淚。然而念及偉大的佛陀尚且不逆人意,我區區凡夫,福薄德淺,豈能隨意「拒絕」,傷害人情?因此我總會準備幾十元美金或幾千元日幣帶在身邊,當有人提出借錢的請求時,我便直言相告,只有將儲蓄的外幣以為捐助,這樣一來,既滿足了對方的請求,也不致彼此難堪。多年以來,或許正因為我向來和任何一個人都沒有借貸關係,互相不倒債,所以情義都能維持得十分長久,想來也是人生一得。

在台灣四十年來,不少報章雜誌向我邀稿,我向來竭盡己力,滿人所願;但近幾年四處弘法,實在抽不出時間,在抱歉之餘,我和對方商量,拿其他地方用過的稿子登載,這種「代替」的方式總能蒙獲對方的諒解。最近電台、電視台爭相邀請我到現場節目中講話,由於法務倥傯,無法排出行程,然而我生性不喜「拒絕」別人,所以只有問對方是否可派弟子前往「代替」受訪,以求兩全,不料有時卻遭對方「拒絕」,有一次「真相電視台」的節目負責人對我說:「他的知名度沒有你的響亮,無法『代替』你。」我也只好徒呼無奈了。

我到世界各地走訪,只要有片刻時間,就到信徒家中做家庭普照,為他們祝禱開示,有一回信徒喜出望外,搬出卡拉OK來招待我,雖說與一襲僧裝不甚相宜,但念及他的一番好意,不忍拂逆,我告訴大家:「可以利用這種現代化的設備來唱誦法語讚偈,將佛法弘揚開來。」說罷,便告辭離去。信徒聽到我的讚美,知道佛教現代化的重要性,對於寺院道場更加護持。這樣的方式不是比嚴厲「拒絕」還要好嗎?還有一次,我應邀作客,主人指啤酒為汽水,舉杯向我表示禮敬,我不明言拒絕,以茶「代」酒向大家回敬,並且藉此機會說明茶與佛教之間的關係。如此一來,餐會氣氛不致尷尬,大家也能從中得到佛法的受益,豈不妙哉!

在雲遊行腳時,所遇到的偶發事件不勝枚舉,但只要抱持一顆靈巧的慧心,以其他方式來「代替拒絕」,都能得到皆大歡喜的結局。像有一次,信徒臨時起意,帶我去拜訪他的一個朋友,卻發現手邊沒帶禮物,我以好話來「代替」,沒想到對方竟因為這一席話而感動,皈依在三寶座下。還有一次,住在桃園的道友帶我去慈湖謁陵,手邊沒有鮮花,我們以誦經來「代替」,護衛的憲兵也十分歡喜地接受。到大陸弘法時,導遊帶我們到北京的國父衣冠塚前致意,我們以一曲〈國父紀念歌〉表示禮敬;後來參觀西湖的岳飛廟,我們又齊聲高唱〈滿江紅〉,這些「代替」的方式讓當地的地陪人員,包括中國佛教協會祕書長蕭秉權先生在內,都耳目一新,同感驚喜。

隨著弘法的腳步越加拓寬,信徒日益增加,送來的禮品堆積如山,這是我心中最不歡喜的事情,但自忖信徒也是基於供養三寶的誠意,實不忍難色「拒絕」,所以我想到一個「代替」的方法,凡收到紅包,我言明會代為轉給常住;凡收到禮品,我也立刻交代侍者交由常住處理。信徒目睹,下一次就不會再送給我個人,而知道要直接捐贈給寺院道場,這樣一來,我樂得無事,對於僧信二眾來說,也是一種最好的身教。

承蒙政府及民間團體的青睞,經常邀請我出來舉辦公益活動,其實佛光山本身的弘法事業也是十方來十方去,社會大眾若能集合群力,必能造成更大的影響,因此我總是提議大家一起來。現在社會上所謂合辦、承辦、協辦的風氣鼎盛,雖不敢說是自己首開先河,但是在推動上應有助成之功。所以直言「拒絕」即使有再好的理由,都是下下之策,若能以積極的方式「代替消極的拒絕」,才是自利利他之道。

「代替拒絕」不是簡單的表面功夫,必須打從心裡先不要有抗拒、排斥的念頭,從而平心靜氣面對問題,尋求解決之道,切忌魯莽行事,遷怒別人。記得三十多年前,我初到宜蘭弘法,一位姓鄭的警察專門和我為難,我講經說法,他要我向他報備註冊,否則不准開講;我罄其所有,買了一台日製幻燈機作為教學道具,又忍痛被他沒收。總之,這樣也不可,那樣也不行,讓我不知如何是好。有一天,宜蘭縣警察局分局長前來向我商借「宜蘭念佛會」,作為警察甄試的考場,我一口答應,給予種種方便,後來他得知屬下對我們諸般為難,第二天,就將這位鄭姓警員調職,從此我們的弘法工作逐漸進入佳境。

十多年前出國弘法,經常遇到海關人員的刁難,他們把行李一一撬開檢查不說,還東問西問,有一句答得不好,又得到另一處接受調查,往往在海關待上半天還出不來。如是數次之後,我想自己應該主動出擊,避免別人的「拒絕」,因此學了幾句英文,每次一到海關,就先面帶微笑和大家打招呼,「Hello!」「How are you?」「Good evening!」「Thank you!」不絕於口。果然,通關時就順利多了。

「拒絕」不好的後果,必須先用好因好緣來「代替」;「拒絕」積弊已久的問題,則應該以循序漸進的方式來「代替」。多年前,政府取締拜拜,舉國譁然,我為文主張以鮮花素果來「代替」;數年前,政府下令拆除違章建築,引起各地反彈,我建議「先建後拆」來「代替」「拒絕」的方式,俾使整頓市容的政策易於推行。近年來毒品氾濫,我配合政府的緝毒決心,舉辦「淨化人心七誡運動」 ,其中有一項「誡毒品」,我呼籲大眾應以關懷病人的心態來看待吸毒者,協助他們以正當的興趣、服務的精神、忙碌的工作、法喜的生活、信仰的熱忱來「代替」毒品。

最近,重大刑案踵繼發生,社會亂象頻仍不斷,李登輝總統大聲疾呼「心靈改革」,我認為「拒絕」不好的心靈應該先找尋「代替品」來治療病因,就如同正在戒煙的人以嚼口香糖來「代替」抽煙,正在戒酒的人以喝汽水來「代替」酗酒,一旦煙酒戒除成功,不用代替品也能悠遊度日。所以,在舉世轟動的「白曉燕命案」發生之後,國際佛光會推出「慈悲愛心列車」運動,我提倡以喜捨「代替」貪欲、以慈悲「代替」瞋恚、以明理「代替」愚癡、以尊敬「代替」我慢、以正見「代替」邪信、以勤勞「代替」懶惰、以惜福「代替」奢侈、以讚美「代替」責備、以感恩「代替」懷恨、以誠實「代替」妄談,我相信如果我們能切實做到,久而久之,必能將心中本自具有、不垢不淨、聖凡一如的平等佛性闡發出來,屆時大家都將生活在一片佛國淨土當中。

諸佛菩薩及高僧大德們最會利用各種善巧方便來「代替拒絕」,像《法華經》中,釋迦牟尼佛不從否定上教人「拒絕」貪愛邪見,而「代」之以三乘教法;《淨名經》中,維摩詰大士不從消極上教人「拒絕」世俗之樂,而「代」之以法樂的施化。提婆菩薩親近信奉邪道的南天竺王,以參政輔佐來「代替」一般行者「拒絕」、輕視的態度,結果舉國人民皆被度化;盤珪禪師收留人人唾棄的小偷,以愛心「代替」一般人「拒絕」、默擯的態度,結果使得佛門多了一位龍象。每次披覽聖典,讀到古聖先賢慈悲度眾的史蹟,都令我感動涕零,後來我自己收徒度眾,更深深感受到「代替」法門的無限妙用。

記得過去我擔任佛學院院長時,曾有學生請求不要那麼早起床、就寢,希望能有多一點時間念書,我自忖有理,立刻改良傳統的課誦程序,將早課、晚課的時間縮短,這種「代替拒絕」的方式既不會動輒改變校規,又能滿足學生合理的要求,所以受到大家的歡迎。此後學生們心裡有事情,都歡喜找我訴說,而我也從中得知學生的學習狀況,彼此坦然相處,其樂融融。

有些學生讀書讀了半學期,興起回家的念頭,要求請假一個星期,我告訴他:「一星期太短了,我幫你請一個月的假,回家看看父母。」結果他們往往十天不到就回來繼續學業,從此不再戀家,而家長們看到兒女們在這裡生活正常,而且變得更孝順,更乖巧,自然也很放心地把子女交給我們。

有些青年男女抱持安貧樂道,弘法利生的理想來山學佛,但由於和來自不同環境背景的同學們格格不入,無法共處,因而萌生去意,他們前來找我,說道:「我實在很喜歡佛光山,捨不得離開,但是到佛學院念書又不習慣,怎麼辦呢?」我告訴他們:「佛光山有很多路可以走,你可以從事教育、文化、弘法、慈善的工作,不一定要讀書。」後來這些人很歡喜地留在常住做事,奉獻心力,表現得可圈可點。

有些弟子在好幾個單位都無法適任,已經到了調無可調的地步,他們前來找我的時候,我總是請他們自己選擇喜歡的工作地點,並且為他們從中斡旋,讓他們如願以償。由於我不輕易「拒絕」,而肯給予機會,結果他們大都能安住身心,勤奮辦道。所以我常覺得:我們對於一些行不通的事情,不一定要「拒絕」,如果能從另外一個角度來為對方多一點設想,給予「代替」的方法,讓他們自由選擇,往往可以獲得圓滿的結果。

在日常生活中,即便是一些不合理的行為,我也很少正面「拒絕」點破,而「代」之以啟發的方式,給予徒眾一些成長的空間。像有些剛入道的弟子一時俗情未泯,經常要求下山,我告訴他們:「可以下山,但要先學好五堂功課。」結果他們在道業上薰習日久,自然就不再喜歡憒鬧的都會。有些剛出家的弟子一心想到國外去學習,但條件又不具足,我和他們說:「必須先學會當地語言,才能請調國外。」這些人當中,有些知難而退,安守現有的崗位;有些則自知不足,從此更加努力。

做事遇到瓶頸在所難免,當這些單位求助於我的時候,我明知其中做法有誤,但自忖申斥「拒絕」只會讓他們畏事怕難,逃避責任,因此「代」之以討論、交流的方式,和他們一起解決問題,久而久之,大家都能從做事當中學習如何克服困境。

有許多人說:

「師父!您何必如此客氣,直接說明『拒絕』就好了。」當然,「拒絕」只要一句話,非常簡便,但是它具有很大的殺傷力,我寧願自己麻煩一點,找尋「代替」的方式,讓對方能夠接受,讓對方能夠成長。我每到一地,均十分留意當地的事物,數十年來,我發覺教育出問題的地方,往往在於父母師長習慣以「拒絕」的態度來對待下一代;而人際關係出了問題的人,大都在於他們經常用「拒絕」的方式來否定別人。所以在此奉勸諸位:要給人信心,要給人歡喜,要給人希望,要給人方便,即使不得已要拒絕的時候,也不要輕易的「拒絕」,而要「有代替的拒絕」;不要立刻就「拒絕」,而要能婉轉的「拒絕」;不要無情的「拒絕」,而要有幫助的「拒絕」;不要傲慢的「拒絕」,而要有出路的「拒絕」。

拒絕要讓對方感到歡喜,拒絕對方要有藝術。

John Grubbs

It's interesting to think that there is this "preventable risk". In my experience, I've found risk to be only manageable as there is risk in everything we do, especially when it come to human nature

Edward Chao

Dear John Grubbs,

This risk type is what I call "internal risks" which is arising from within the organization, that are controllable and ought to be eliminated or avoided. In addition, best managed through active prevention: monitoring operational processes and guiding people’s behaviors and decisions toward desired norms.

Thanks for your comments.

Dr. Chao

Mark Powell

Edward,

I think the terminology you have chosen for native English speakers is a bit unfortunate.

I understand what you are saying, but the term "preventable" does not connote to native English speakers the definition you have assigned to it.

Mark Powell

Edward Chao

Dear Mark Powell,

Thanks for your response.

This terminology perhaps not suitable to native English speakers, it's another definition concerning about the "internal risks" which is arised from within the organization, that are controllable and ought to be eliminated or avoided. Examples are the risks from employees’ and managers’ unauthorized, illegal, unethical, incorrect, or inappropriate actions and the risks from breakdowns in routine operational processes.

Perhaps, you can give me better suggestions concerning about this terminology.

Best regards.

Dr. Chao

Mark Powell

Edward,

To me, your term "internal risks" seems to capture what you have described so far quite well.

All of your examples are what I would naturally think of as a company's internal risks.

Mark Powell

Sherif Dawood , MBCI, MBA, ITILv3, M.Sc.

Second Mark's opinion

We can have preventive controls as part of the control structure for managing certain risk, but we can never guarantee the prevention of the risk. If there is a risk, there will be always a residual risk till the risk becomes irrelevant

William Thorlay

Dr. Chao,

I think your definition on "internal risks" is well understood. On the other hand, I have to agree with Mr. Grubbs when he says that risk is something inherent to everything we do. As far as human behaviour is concern, human reliability is becoming more and more applied within the organizations worldwide.

Tracy Dcruz

We could provide payment gateway for many high risk industries like Gaming, Casino, Forex Pharmacy, Nutra, Binary, Replica, Pet shops, Tour and travel operators, Gaming, Gambling, Lotto and lottery, Headshops, Medical marijuana and many more.

We hope to be able to get you an account, with surety and this will be much more reliable which will have you being paid within shorter period for your transactions on credit card.

Tracy Dcruz Skype id: connect2vspay email id: sales@vspayglobal.com

Stephen McManus

When discussing risks, whether internal or external, the use of "preventable" would equate to avoid the risk....this means the risk probability and/or the impact must go to zero.

In practice, it is often almost impossible to prevent risks from occurring or having an impact if they do occur without having a significant trade-off on one of the other constraints or objectives a project is trying to meet. So in practice there should be two questions regarding a significant risk and the desire to "prevent" the risk.

* - Is it more important to do the project or not experience the risk?

* -If a prevent or avoid response is put in place, is the cost or benefit worth the trade-off of project objectives not being fully met.

Finally, in practice we most often have to determine how much is the project willing to invest in reducing a risk or increasing an opportunity and still leave on the table residual risk....what is the risk appetite of the key stakeholders.

Edward Chao

Dear Stephen McManus,

What you have indicated that "in practice we most often have to determine how much is the project willing to invest in reducing a risk or increasing an opportunity and still leave on the table residual risk", I agree with your viewpoints.

The decision-makers has the responsibility to analyze the keypoints whether the cost or benefit is worth the trade-off of project objectives not being fully met.

According to my past experiences,the first step in creating an effective risk-management system is to understand the qualitative distinctions among the types of risks that organizations face.

Finally, you have to determine how much is the project willing to invest in reducing a risk or increasing an opportunity and still leave on the table residual risk.

Thanks for your comments.

Dr. Chao

10-Feb.-2015

Michael Allocco, PE, CSP

MOST RISKS ARE PREVENTABLE GIVEN….

The understanding of a (system) accident life cycle:

• Implement safety axioms to assure that risks are identified, eliminated or controlled to acceptable levels;

• Apply proactive, predictive, and reactive methods to understand hazards and associated risks;

• Consider how an adverse propagation can start? A poor decision associated with the system (integrated human, machine and environment);

• The decision results in a latent, dormant, hidden (hazards) situation;

• The hidden situation is triggered by a condition or situation (other hazards);

• Adverse sequences can be complex to simple;

• The elements of the system support the adverse progression(s): conditions and/or actions;

• The adverse process may progress unless detected, or progression continues and harm may result;

• If causality or contingency action is unsuccessful additional harm can result;

• Eventually the system needs to be brought back to a stable state.

Edward Chao

Dear Michael Allocco,

The statements you have pointed out makes sense, and thanks for your reply with sincerity.

Dr. Chao

Pierre Lommerse

Dear Edward,

I tend to say risk is the only certainty in your life the difference is how you cope with it, other thought is doing business is consciously taking risk.

When we discuss the risk factor we have to keep in mind it is not risk management but overall management, think of the loop identify, assess, accept/not accept, control. So when we discuss the “internal risks” we have to be aware of them. My experience is that one of the biggest risks is, motivation, being proud to be part of the organization etc.

Edward Chao

Dear Pierre Lommerse,

I'm very appreciated with your reply. According to my past experiences,the first step in creating an effective risk-management system is to understand the qualitative distinctions among the types of risks that organizations face. Finally, you have to determine how much is the project willing to invest in reducing a risk, how to avoid and manage is an important issue to take into consideration. Thanks for your comments again.

Dr. Chao

John Mallino

Preventable risks are risks that can be engineered out of the design. With that said, if asked which specific risks are preventable. I would say OSHA top ten most cited violations. No excuse for these risks to be active at your job site.

http://www.safetyandhealthmagazine.com/articles/11136-osha-announces-top-10-most-cited-violations-for-2014

David Brady

John M got it right. The only way to make a risk preventable is to eliminate it altogether, either removing it by re-engineering or or changing the process if possible, e.g. if the risk is flying then drive or take the train. Although remember that eliminating a risk may introduce a secondary risk.

John O'Sullivan MIEAust CPEng

Edward,

Glad to see your comments have brought up numerous valid replies. In my experience these 'internal risks', while being largely preventable or able to be mitigated (or at least should be so) can also be very insidious because many of them can arise from the company 'culture'. But when a company's 'culture' is flawed identifying and mitigating those risks can be a daunting task because people may not even realise the risk exists, let alone where it stems from - 'it's how we do business'. In these companies (read 'large organisations') those people in positions of authority have generally reached those positions because they understand how to 'work the system' and that knowledge and understanding becomes their power base. When you start to identify and address those internal risks be prepared for some potentially serious pushbacks because someone's power base is suddenly being threatened.

Interested to see if anyone else shares these views.

John

Edward Chao

Dear John O'Sullivan,

First, I'm very appreciated with your reply.

Secondly, according to your past experiences which said in your comments,'internal risks', while being largely preventable or able to be mitigated (or at least should be so) can also be very insidious because many of them can arise from the company 'culture'. But when a company's 'culture' is flawed identifying and mitigating those risks can be a daunting task because people may not even realise the risk exists.

In fact, the culture seems to play an important factor in 'internal risks', which can also be very insidious because many of them can arise from the company 'culture'.

Thirdly, when we discuss the risk factor we have to keep in mind it is not risk management but overall management, think of the loop identify, assess, accept/not accept, control. So when we discuss the “internal risks” we have to be aware of them.Finally, you have to determine how much is the project willing to invest in reducing a risk, how to avoid and manage is an important issue to take into consideration.

Finally, I'm very appreciated with your professional comments.

Sincerely,

Edward

John O'Sullivan MIEAust CPEng

Thanks Edward,

From a Quality point of view the causes of these types of risks (ie variations in output) would usually be termed 'common causes'. Any unexpected, uncontrolled or unauthorised variation in output results in risk. The only way to fix them is by fundamentally changing the 'system' or, in some situations, the system's implementation. Common causes arise when 'everyone is doing it'.

John

Edward Chao

Dear John O'Sullivan,

I'm very appreciated with your comments.

I agree with your viewpoints, the better way to fix 'internal risks' is by fundamentally changing the 'system' or, in some situations, the system's implementation.

You provide another solution to fix the 'internal risks'.

Sincerely,

Edward

James Andrae

Edward

I agree with your comments in general, and yes the examples you identified are internal and "preventable" through a variety of actions. (there is no sure fire mitigation for rogue trading).

In Australia we have taken the risk management of physical injury to a new level. I worked for a company that went into the Guinness book of records when it achieved a million hours without any injuries. Preventable risks that have direct impact on the bottom line and lives.

While nothing is perfect and some solutions do open the door to other risks, it is none the less the most important exercise and question for a risk manager to undertake. This is the heart of the process to determine Board risk appetite declarations, Risk Policies, Corporate structures etc, etc...

I prefer to approach an organisation as a blank sheet, identify risks and put them in 3 columns and then spend some time analysing what is the understanding of each risk by the relevant staff. I'm sure you are doing this process since you started at the same point I did .

The bottom line is the identification of the universe of risks I have to have, I want to have, and I don't want to have. Then devise a strategy to address these.

Of course it is a very involved processes and you need to move at least 3 to 6 iterations to ensure no new risks are accidentally introduced and what residual risks remain and so on.

If done right, the rewards are astronomical, and most importantly it sets the culture. Everyone has to get on board and risk management is embedded in the hearts and minds just through the exercise.

Qualitative benefits are numerous, least of all, the insights gained.

I once worked for a company that wanted to address 1 preventable risk.

The cash flow risk. They wanted greater certainty of revenue. In attempting to mitigate this risk, it created new risks, some of which were an even higher order of risk. But once we went through the process and mapped it out down to the most minute issues stressed in 6 different ways, the CEO was so impressed this strategic thinking became the norm for every action undertaken You cannot ask for a better culture.

Happy to provide further details in private if you want to contact me.

Edward Chao

Dear James Andrae,

I'm very appreciated with your professional comments about the topic:"What's preventable risks and how to effectively manage?". According to your viewpoints, the bottom line is the identification of the universe of risks I have to have, I want to have, and I don't want to have. Then devise a strategy to address these. I agree with your viewpoints stated. Your past experiences in two companies which gave me some hints in solving preventable risk. You are an expertise in facing risks, therefore you know how to solve in better way. According to my past experiences,the first step in creating an effective risk-management system is to understand the qualitative distinctions among the types of risks that organizations face.

To be sure, companies should have a zone of tolerance for defects or errors that would not cause severe damage to the enterprise and for which achieving complete avoidance would be too costly. In addition, companies should seek to eliminate these risks since they get no strategic benefits from taking them on in general. A rogue trader or an employee bribing a local official may produce some short-term profits for the firm, but over time such actions will diminish the company’s value.Finally, you have to determine how much is the project willing to invest in reducing a risk, how to avoid and manage is an important issue to take into consideration.

Happy to receive your comments and if possible, we can discuss more details on risk managements in private if you don't mind.

Best regards.

Edward

John O'Sullivan MIEAust CPEng

Edward,

I believe one principle is worth always remembering when dealing with risk, regardless of the type, source or severity of that risk. and that is:

Regardless of what business you THINK you are in, you are in the PEOPLE business.

Cheers,

John

Edward Chao

Dear John,

Thanks for your reply.

You have mentioned that when dealing with risk, "Regardless of what business you THINK you are in, you are in the PEOPLE business." It is useful for me how to treat the risk happened in the coming future.

In my experiences running on project managements, I usually think that risk management can include the following activities

* how risk will be managed in the particular project. Plans should include risk management tasks, responsibilities, activities and budget.

* a risk officer – a team member other than a project manager who is responsible for foreseeing potential project problems. Typical characteristic of risk officer is a healthy skepticism.

* live project risk database. Each risk should have the following attributes: opening date, title, short description, probability and importance. Optionally a risk may have an assigned person responsible for its resolution and a date by which the risk must be resolved.

* anonymous risk reporting channel. Each team member should have the possibility to report risks that he/she foresees in the project.

Very thankful for your comments again.

Best regards.

Edward

Edward Chao

There are two questions regarding a significant risk and the desire to "prevent" the risk.

The first question has to be considered is "Is it more important to do the project or not experience the risk?", the second is "if a prevent or avoid response is put in place, is the cost or benefit worth the trade-off of project objectives not being fully met." (Sited from Stephen McManus) I think that it's necessary for us to think about the process how to prevent the coming risk and the best solution.

As what I suggest in the former comments 'Maintaining live project risk database.'

In fact, each risk should have the following attributes: opening date, title, short description, probability and importance. Optionally a risk may have an assigned person responsible for its resolution and a date by which the risk must be resolved.

Edward.

Christopher Jeffrey

Several great comments attached here!!! A really good read... So I will add mine.... An essential point to risk management often understated is the risk appetite or tolerance levels for the company. These levels can dramatically change the overall scope and cost of projects! These levels often fluctuate based on the discipline they are within... IE... Safety to personnel, environment, financial or reputation. That is to say some companies will withstand higher risks in let's say a financial discipline as they would not withstand with regards to safety! A true understanding of risk encompasses all disciplines and the tangent way they ALL intersect...

Michael Allocco, PE, CSP

FOOD FOR THOUGHT…SYSTEM THINKING AND SYSTEM RISK…

Getting the big picture is helpful when assessing risk:

Considering system (RISKS) accidents people may not know how to connect the dots within complex systems, nor think inclusively, or holistically, nor comprehend dynamics, induction or deduction, nor understand expensive variables, interfaces and interactions.

A so-called “safe” system equates to the identification, elimination and control of safety-related (system) risks; throughout the life cycle of the system, and system accident. We should go about the effort of system-level hazard analysis and risk assessment, and validating and verifying the system risk controls.

System thinking will not be acquired from a theory, or book, or from formal schooling. System thinking is gained via experience during professional practice.

Unfortunately, many have a limited understanding of complexities within integrated systems comprised of hardware, software, firmware, the human and complex environment. One has to understand interfaces and interactions associated with complex systems. We cannot oversimplify thinking about failures, adverse events and functions. Not everything is stochastic (probabilistic). System analysis requires many forms of additional thinking: abstract, holistic, system, quantitative, objective, subjective, temporal (life cycle), and critical.

System thinking can be applied to an entity. A ’system” is a source of abstraction. System axioms all equate to context. Experienced system risk analysts may be aware that it is all connected. There is flexibility, abstraction, and pliability in the concept of a system, system of systems, and families of systems. These entities are comprised of humans, machines, and the environment. In an oversimplification one must understand the interactions and interfaces of the defined system under consideration. Your system thinking abilities can be limited based upon the knowledge of applied system axioms.

Edward Chao

Dear Michael Allocco, Thanks for your comments. Getting the big picture is helpful when assessing risk, in addition, how risk will be managed in the particular project. System thinking is gained via experience during professional practice. Simultaneously, as you have said 'system analysis requires many forms of additional thinking: abstract, holistic, system, quantitative, objective, subjective, temporal (life cycle), and critical.' The good plans should include risk management tasks, responsibilities, activities and budget, if not, the plans have to take the uncertainty and potential risk.

Thanks for your reply.

Edward

Michael Allocco, PE, CSP

Edward....your welcome.

DESIGNING RISK MANAGEMENT PROGRAMS,,,

• I understand that there are cook book approaches in risk-related standards; which may or may not be appropriate. Firstly, it all depends on the actual identified system risks throughout the life cycle of the entity under evaluation. As stated, an inclusive system-level hazard/threat analysis provides the risk-driven requirements in order to design RM program requirements.

• Any forms of risk of harm: losses, threats, vulnerabilities, loss of key people, loss of assists, valuable papers, trade secrets, data and information, fire losses, fleet losses, facility catastrophes, environmental and weather events, any contingency, causality, etc.; can be evaluated. It all depends on how the analysis and risk assessment criteria are developed.

Edward Chao

Michael, I fully agree with your viewpoints. Any forms of risk of harm: losses, threats, vulnerabilities, loss of key people, etc., could be estimated and evaluated via the analysis and risk assessment criteria which could be developed. Thanks for your comments.

Edward

Michael Allocco, PE, CSP

Your welcome....Mike

https://www.linkedin.com/grp/post/2324725-5969003244674916354?trk=groups-post-b-all-cmnts

Copy the above, and then put the website in the web.